We’re facing a global cost of living crisis that is hitting everyone. How to drastically cut expenses. Particularly low earners.

Inflation is at 8% in the UK and could reach as high as 10% in the months to come.

With things only expected to get worse, here are some easy ways to lower your expenses and save money monthly.

1. Track your spending habits

Sounds boring, but this is the only way you’re going to be able to see where your bad habits are and where you can cut back

Get an app like Snoop (UK) or Mint (US) and track your spending for 30 days – it will be an eye-opener, I guarantee.

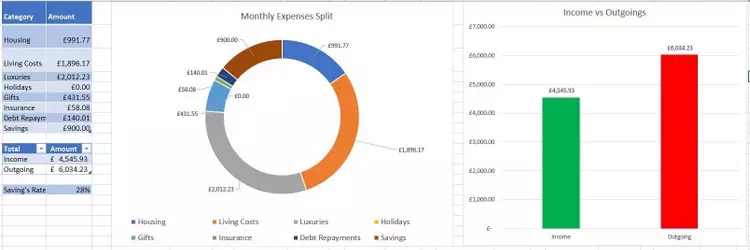

2. Use a budget

This does not have to be complicated.

It’s just a simple plan for where your money needs to go.

Having a plan, in addition to tracking your spending so you can make better, intentional financial decisions throughout the month with save you a lot of money.

If you need a template, I have a free tool you can download at the link here.

Also read: 6 Budget Alternatives

3. Review subscriptions

We all have subscriptions for TV, streaming services, internet, cell phones, weight loss programs, you name it

Once set up, most don’t think too much about them

Well, now’s the time to critically review what you need and cancel the rest

4. Reduce Electricity Use

Electricity costs account for ~12% of the average household budget

This is set to increase dramatically as energy prices soar

So it’s a great time to start making conscious decisions about your energy consumption

Here are some tips

- Turn devices off at the wall instead of leaving on standby

- Switch to energy-efficient bulbs

- Turn heating down by a degree or 2

- Turn off lights in rooms you’re not using

Google ‘how to lower energy use’ for more.

5. Lower Your Housing Expenses

One of the largest outgoings on your budget will be housing costs

If you rent, consider getting a roommate to foot some of the rent and bills

If you own, consider refinancing to a lower rate or renting out a room in your home short-term

6. Consolidate Debt & Lower Interest Rates

If you have multiple cards/loans, this step can drastically reduce your outgoings

Consider consolidating all your debts into a single loan with more favorable rates and terms to lower overall payments and interest

7. Reduce Your Insurance Premiums

The first step is to use comparison sites to find lower premiums

Next, adjust the policy details:

- Are you ‘over-insuring’?

- Is the value of your car accurate

- Increase the excess or deductible

- NEVER auto-renew

8. Eat at Home

Preparing & eating meals at home can save a lot of money.

Weekly meal planning can make it easy. Figure out what you will eat for the week, plan it, then stick to it.

The cost per calory to eat out is many times what it will cost to eat quality home-cooked meals.

9. Shop with a List

Saving money at the grocery store all starts with a shopping list

This simple habit can end up cutting food expenses, help with meal planning and, if you stick to the list, eliminates impulse buying

Keep a running list throughout the week.

10. Freeze Your Credit Cards

Credit card debt is a huge burden. It’s easy when you don’t have the money on hand, to use a credit card, but the balance can grow fast, particularly if the interest rate is high

You can temporarily freeze your card to stop new purchases.

You can also call them and ask for a freeze on the interest being charged if you’re struggling to keep up with payments

This is always worth asking them about as it cant free up cash flow for more essential expenses

If you’re struggling, call your card issuer and ask for help

11. Rewards points/cashback

If you regularly shop at the same stores, consider if they offer a loyalty card where you collect points which can be redeemed as cash in-store

Also, check sites like topcashback before you buy anything

Cashback can range from 2 – 50%!

12. Pay Off Your Debts

Debt is a cashflow killer

The faster you get rid of debt, the more cash flow you’ll have

As mentioned earlier, to pay off debt, credit card debt must be a major focus as this usually has the highest interest rate

Pay more than the minimum!

Bonus tip!

As mentioned, cash flow is king

For many, the amount you can earn is far greater than the amount you can save by reducing expenses

Starting a side hustle is the easiest way to make some extra cash each month.

More than I ever could have cut from my expenses.

This could involve:

- Selling ebooks

- Affiliate marketing

- Flipping/reselling

All are quick and easy to start and just require a phone and a laptop.

Written by Financially Savvy